bbk is minimal R client for the following APIs:

In the future, it may be extended to other central banks and financial institutions. Feel free to open an issue if you have a specific request.

You can install the released version of bbk from CRAN with:

install.packages("bbk")And the development version from GitHub with:

# install.packages("pak")

pak::pak("m-muecke/bbk")bbk functions are prefixed with either bbk_ or

ecb_ depending on the origin of the data and follow the

naming convention of the APIs. The usual workflow would be to search for

the time series key on the ECB

Portal or Bundesbank

website and then use it to retrieve the data.

library(bbk)

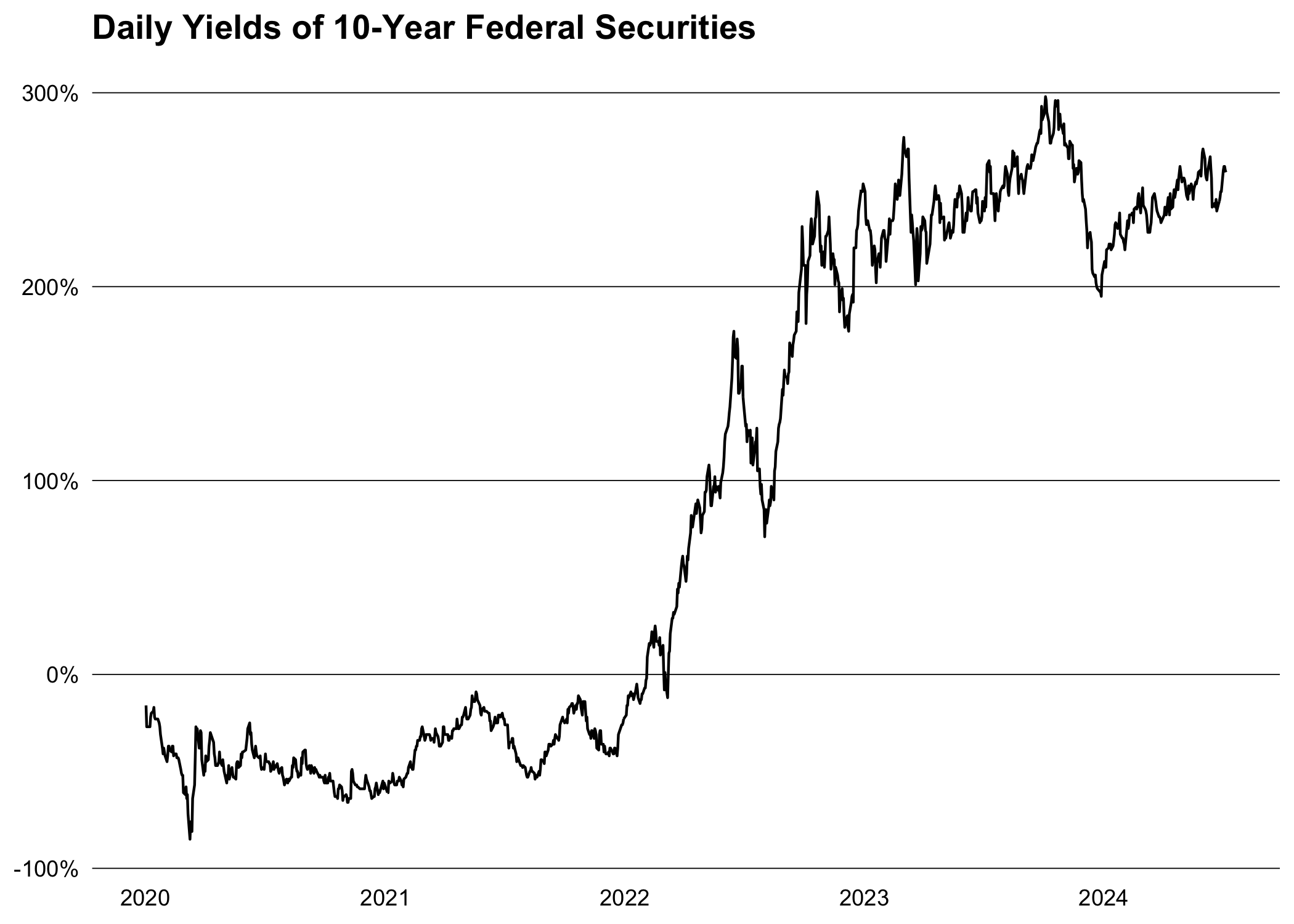

# fetch 10 year daily yield curve

yield_curve <- bbk_data(

flow = "BBSIS",

key = "D.I.ZAR.ZI.EUR.S1311.B.A604.R10XX.R.A.A._Z._Z.A",

start_period = "2020-01-01"

)

#> [1] "data/BBSIS/D.I.ZAR.ZI.EUR.S1311.B.A604.R10XX.R.A.A._Z._Z.A"

str(yield_curve)

#> Classes 'data.table' and 'data.frame': 1296 obs. of 25 variables:

#> $ date : Date, format: "2020-01-02" "2020-01-03" ...

#> $ key : chr "BBSIS.D.I.ZAR.ZI.EUR.S1311.B.A604.R10XX.R.A.A._Z._Z."..

#> $ value : num -0.16 -0.27 -0.27 -0.27 -0.27 -0.22 -0.2 -0.19 -0.17 -..

#> $ title : chr "Yields, derived from the term structure of interest "..

#> $ freq : chr "daily" "daily" "daily" "daily" ...

#> $ bearer_reg : chr "I" "I" "I" "I" ...

#> $ item : chr "ZAR" "ZAR" "ZAR" "ZAR" ...

#> $ valuation : chr "ZI" "ZI" "ZI" "ZI" ...

#> $ currency : chr "EUR" "EUR" "EUR" "EUR" ...

#> $ issuer_class : chr "S1311" "S1311" "S1311" "S1311" ...

#> $ listed_sub : chr "B" "B" "B" "B" ...

#> $ security_class: chr "A604" "A604" "A604" "A604" ...

#> $ maturity : chr "R10XX" "R10XX" "R10XX" "R10XX" ...

#> $ interest_type : chr "R" "R" "R" "R" ...

#> $ interest_rate : chr "A" "A" "A" "A" ...

#> $ redemption : chr "A" "A" "A" "A" ...

#> $ certificate : chr "_Z" "_Z" "_Z" "_Z" ...

#> $ coverage : chr "_Z" "_Z" "_Z" "_Z" ...

#> $ rating : chr "A" "A" "A" "A" ...

#> $ time_format : chr "P1D" "P1D" "P1D" "P1D" ...

#> $ decimals : int 2 2 2 2 2 2 2 2 2 2 ...

#> $ unit : chr "PROZENT" "PROZENT" "PROZENT" "PROZENT" ...

#> $ unit_mult : chr "0" "0" "0" "0" ...

#> $ category : chr "GKZR" "GKZR" "GKZR" "GKZR" ...

#> $ unit_eng : chr "percent" "percent" "percent" "percent" ...

#> - attr(*, ".internal.selfref")=<externalptr>